Fintech Breakfast 2024: Advancing Financial Inclusion in Kenya

In recent years, Kenya has emerged as a hub for financial technology (fintech) innovation, characterized by a dynamic and rapidly evolving landscape. Fueled by advancements in mobile technology and a conducive regulatory environment, Kenya’s fintech sector has experienced exponential growth, revolutionizing the way financial services are accessed and delivered across the country.

At the heart of this transformation is the pioneering mobile money platform, M-Pesa, launched in 2007 by Safaricom, Kenya’s leading telecommunications provider. M-Pesa’s success in enabling secure and convenient mobile payments has not only transformed Kenya’s financial landscape but has also served as a global benchmark for mobile money innovation.

Building on the success of M-Pesa, a diverse range of fintech startups and innovators have emerged, offering innovative solutions to address various financial needs and challenges faced by individuals and businesses in Kenya. From digital lending platforms and peer-to-peer payment systems to investment apps and insurance services, the fintech ecosystem in Kenya is vibrant and diverse, catering to a wide range of financial requirements.

Moreover, the government’s commitment to fostering innovation and financial inclusion, as outlined in initiatives such as the National Fintech Strategy and the Digital Economy Blueprint, further underscores Kenya’s position as a leading fintech hub in Africa. With a young and tech-savvy population, coupled with a growing appetite for digital financial services, Kenya’s fintech landscape is poised for continued growth and innovation, driving financial inclusion and economic empowerment across the country.

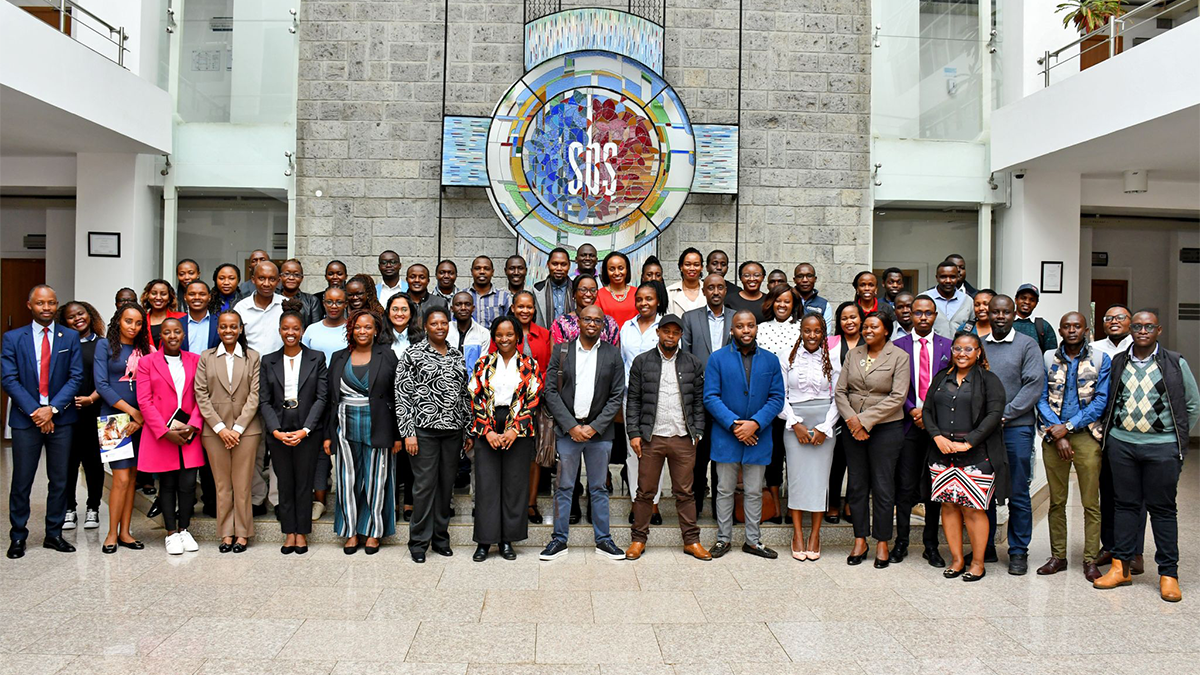

Despite this remarkable progress, a significant portion of the population still lacks access to essential financial tools and resources. It is against this background that Strathmore University Business School organized the second Annual Fintech Breakfast. This year’s edition brought together more than 100 stakeholders in the Kenyan Fintech space to discuss challenges and opportunities. Speaking while giving his keynote address at the event, Ali Kassim Hussein, The Chairman, Association of FinTechs in Kenya highlighted four key barriers in advancing financial inclusion in Kenya include:

Financial Literacy

Many individuals, particularly in rural and underserved communities, lack the knowledge and understanding of basic financial concepts, making it difficult for them to engage with formal financial services. Without the necessary literacy skills, people may struggle to make informed financial decisions, save for the future, or access credit responsibly.

Inadequate Infrastructure

In addition to low financial literacy, inadequate infrastructure poses another obstacle to financial inclusion. Limited access to reliable internet connectivity and banking infrastructure in remote areas hinders the delivery of financial services to those who need them most.

Regulatory barriers

Regulatory barriers also play a significant role in limiting financial inclusion. Complex regulations and bureaucratic processes can deter financial institutions from offering services to low-income and marginalized populations, leading to further exclusion. Simplifying regulatory frameworks and promoting innovative financial solutions tailored to the needs of underserved communities are essential steps toward fostering inclusion.

Socio-economic factors

Socio-economic factors such as poverty, gender inequality, and limited access to education contribute to the challenge of financial inclusion in Kenya. Women face unique barriers to accessing financial services, including cultural norms, discriminatory practices, and lack of collateral. Addressing these socio-economic disparities requires comprehensive interventions that empower vulnerable groups and promote inclusive economic growth.

Mr. Kassim emphasized the need to adopt a multi-stakeholder approach in the bid to advance financial inclusion in Kenya. “Governments, financial institutions, civil society organizations, and the private sector must collaborate to address the root causes of financial exclusion and implement sustainable solutions. Leveraging technology, such as mobile banking and digital payments, can expand access to financial services and bridge the gap between urban and rural areas,” he added.

Article by Juliet Hinga

Share This Story, Choose Your Platform!

Your journey to business excellence starts here. Subscribe today and be at the forefront of innovation and leadership.